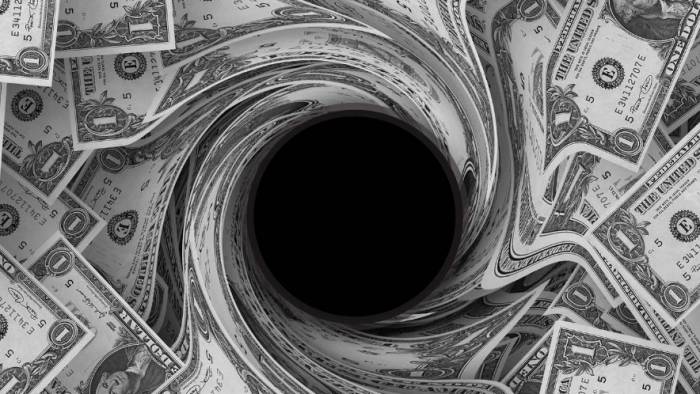

UK on Brink of Bankruptcy with £20B Deficit; US Near Collapse?

It could truly be said that one may not have eaten pork but has certainly seen pigs run. Speaking of national bankruptcy is not such a novel concept, after all, there have been countries in history that have declared bankruptcy. However, if today we are talking about the bankruptcy of a country like the United Kingdom, would you believe it?

The once-great Britain, has it really fallen? The former industrial powerhouse now declaring bankruptcy does seem quite inconceivable. According to official media reports, the newly appointed British government has announced that the country has gone bankrupt, with a fiscal deficit as high as 20 billion pounds. But does this move by the British government really mean that the UK has gone bankrupt, or is there another motive? If the UK declares bankruptcy due to excessive deficits, then the United States, with a total debt of 35 trillion, is probably also on the brink of bankruptcy.

UK Declares Bankruptcy?

When it comes to the UK, it is probably not unfamiliar. In the long river of Chinese history, the UK is an unambiguous pirate. Now, with the news of bankruptcy coming from across the ocean, many people in China can't help but cheer. However, has the British government really become insolvent as claimed, and gone bankrupt? Or is this just a means used by the newly appointed government to default on its debts?

According to the latest news, on July 29th, the British government publicly released their audit report on the state of the national economy.

Advertisement

Based on the report released by the residence of the UK's Chief Steward, Starmer, this report will reveal to us all the fact that the UK has now fallen into an embarrassing situation that should be described as "bankrupt" and "disintegrated."

The newly appointed government claims that the UK's current debt is so high that it can no longer be repaid, and it has shifted the blame to the previous government.

The British government has also recently revealed that the severe shortage of funds in their country has become so serious that it has even affected the British Royal Navy.Especially their second ship of the "Queen Elizabeth" class aircraft carriers, named "Prince of Wales," could possibly be sold to their ally at a price 3.5 billion pounds below market value due to this issue.

Otherwise, this aircraft carrier might have to wait alone for storage in the dockyard or retire directly.

It is worth mentioning that although this aircraft carrier named "Prince of Wales" officially joined the Royal Navy in 2019, and the number of missions at sea since then is not much, but you know, this is a 70,000-ton ship with only a short service life of five years, and in fact, its condition can be described as "90% new"!

For such a brand-new warship, it is astonishing that it is even considered to be sold at a low price, which shows that the current British financial situation is really very bad!

However, has the UK really reached this point? The facts may not be so.

Firstly, the new Prime Minister believes that our Conservative Party was playing tricks before, deliberately not telling the truth to the people, saying that our UK's financial problems are actually quite serious, and at least there is a big hole of 20 billion pounds to be filled.

Then, the entire UK's debt has now accumulated to as much as 2.69 trillion pounds, and the newly appointed Prime Minister thinks it definitely won't do if it goes on like this.

However, the former Prime Minister has resigned and left, and the new Prime Minister doesn't want to take this hot potato, so he directly announced that our UK government is bankrupt.

This move not only shifts the blame to the previous government but also provides a high-sounding reason for himself to collect taxes, and even has a hint of debt default.

And ever since the UK announced the news of national bankruptcy, the global market has been shaken.This matter is not only affecting the UK's own economy and international standing but could also have an impact on currency exchange rates. However, this does not mean that the British government is powerless.

In fact, the cunning think-tanks in the UK have already conducted relevant research. They believe that if they could increase the tax burden on those who are extremely wealthy, they might actually find some new sources of revenue to alleviate the domestic fiscal pressure!

The UK's wealthy population is not small, so in the current financially strained environment, it seems to be a good idea to get some money from them.

However, this matter is not so easy to handle, and it could encounter various political and social resistances. Moreover, the British government still needs to consider how to adjust the tax policy just right, so as not to cause too much negative impact on economic development.

So far, it seems that the British government's declaration of bankruptcy is just an excuse for the newly appointed government to evade responsibility.

With the spread of the news of the British government's bankruptcy, many people naturally think of the United States, which has become wealthy through debt. Will it follow the UK's footsteps? After all, the United States' current debt is not a small amount.

Is the United States far from bankruptcy?

As the saying goes, what goes around comes around. Relying on the hegemonic status of the US dollar, the United States has wildly issued US debt and printed money, and its current debt has reached as high as 35 trillion US dollars. Such a huge amount, even the annual interest expenditure is not a small number. Faced with such great pressure, many people are curious, will the United States really pay it back?

If the debtor were China, there would definitely be borrowing and repaying, after all, the Chinese people's nature is that owing others is not good. But if it were the United States, it is probably gone without return. Coupled with the UK's debt default and bankruptcy declaration, the self-interested United States may also follow the UK's footsteps and declare bankruptcy.According to the latest data released by the IMF, at the end of April, the UK's public debt ratio relative to GDP was significantly lower than that of the United States. This implies that the United States' debt situation is even more severe than that of the UK. Now that the UK has declared bankruptcy, the US may not be far from bankruptcy either.

After the Federal Reserve began implementing interest rate hikes in 2022, the US long-term treasury bonds may face a massive interest burden. Based on the warning issued by billionaire Elon Musk on July 23, he believes that the US is now on the brink of bankruptcy because they need to pay a staggering $1.14 trillion in national debt interest this year, which is equivalent to 76% of total tax revenue.

According to the research estimations of economists Maharey and Jim Richards, by 2024, the interest on the debt that the US needs to repay may exceed social security expenditure, soaring to become the largest annual expenditure, reaching an astonishing $1.6 trillion!

Faced with such a high interest expenditure, coupled with the decline in economic development and the rise in unemployment rates in the US since the end of the pandemic, the US's current debt repayment capacity is worrying. In addition, the US is still printing a large amount of money, which undoubtedly accelerates the devaluation of the dollar. Now, the US's debt repayment may only be a pipe dream.

Although the US has not yet declared bankruptcy like the UK, given the current economic situation and the US's style, it is not impossible for the US to declare bankruptcy in the future. At present, in the face of this situation, China should take precautions and take certain measures to minimize losses. After all, if the US declares bankruptcy, the global economy will inevitably be severely impacted.

The UK's bankruptcy incident is a wake-up call for all countries! Nowadays, we are in the wave of globalization, and the economies of all countries are closely connected. Therefore, if one country's economy encounters problems, it is very likely to affect the stability of the global economy. Those who always try to get rich without working hard and rely on debt to get rich will one day be backfired by debt.

Live a Comment